Published 18:39 IST, July 8th 2024

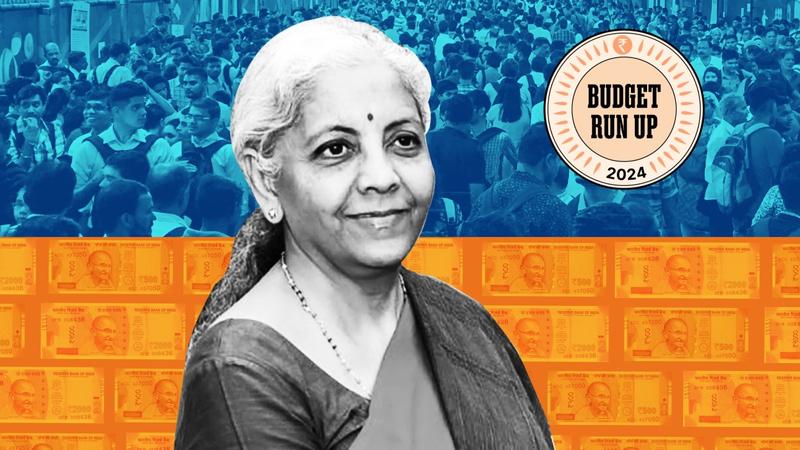

Budget 2024: Industry calls for tax relief to stimulate growth

The industry has also called for reducing corporate taxes, phasing out tax exemptions, and broadening the tax base to spur economic growth.

Budget 2024: Industry calls for tax relief to stimulate growth

| Image:

Republic Business

- Listen to this article

- 3 min read

Advertisement

18:39 IST, July 8th 2024